Rising prices of building materials: includi as an experience expert

Looking at our recent tenders based on our usual key figures, we see that overall the tender result was about 15% higher in mid-2021 than our 2019 key figures. Placing our recent experience with projects in construction teams under the lens, we see that construction team partners notice a price increase of approx. 18% from 2021-2022. The trend is confirmed even stronger; the prices just keep rising!

NOTE: The figures shown in this blog post serve as an example of the fluctuating material prices in the interior design market. They mainly relate to the Dutch interior industry as not all German figures are available.

Increased prices building materials over the past two years

A general index for interior projects is not available in both the Netherlands as Germany. To create an index, includi obtained an overview of market trends at different scales. Several leading sources and organizations were consulted for this purpose:

- Statistics from the Dutch Central Bureau of Statistics (CBS)

- Indexes from the German BKI.de (Baukostenindex, Building Cost Index)

- The Schmelzer Stahlpreisindex (German steel price index)

- The Dutch umbrella trade association CBM, trade association for the interior construction and furniture industry

- One of the Netherlands’ largest manufacturers of project furniture.

Thanks to these reliable sources, we have insight into producer prices (PPI) on the furniture product group and sales, import and consumption prices on specific material groups such as wood, metal and textiles (via CBS). Because of this and ourown work, we are also well informed about general market developments and specifically the field of interior construction and furniture industry (via CBM). In addition, we do a check on the development on the producer side concerning the concrete impact on price development.

Business survey shows sector’s steady price climb

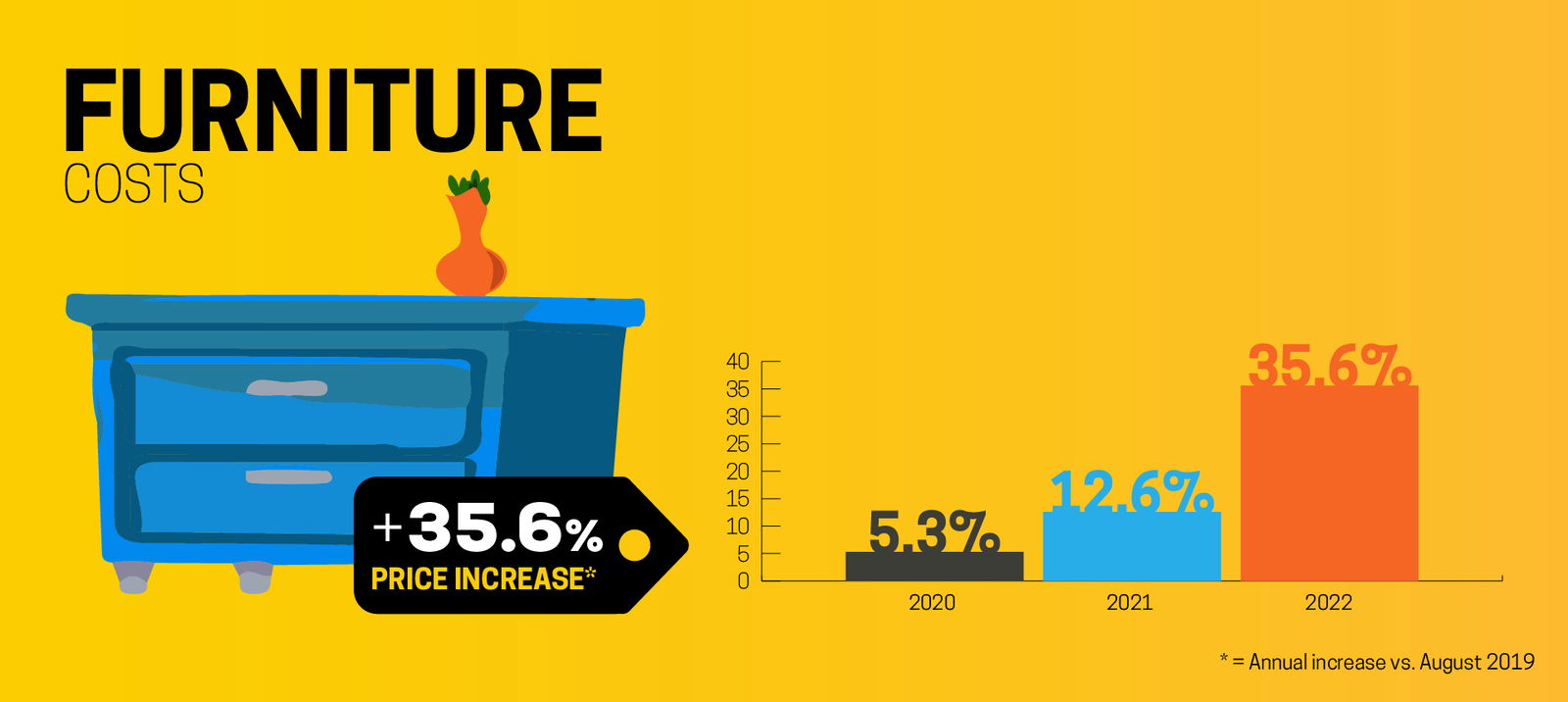

The business survey of CBM shows a market-wide picture of developments. The survey also contains a general picture of the extent of price increases within the interior construction and furniture industry. Here we see a strong increase from more than 5% to more than 10% in 2021. The latest figures date from the second half of 2021.

Furniture figures confirmed

To verify the figures from CBS and the CBM, we contacted one of the Netherlands’ largest furniture manufacturers. In two steps, they responded with a price increase for their products in the last six months: 7% in December 2021, and another 6% increase in May 2022, confirming the above trends.

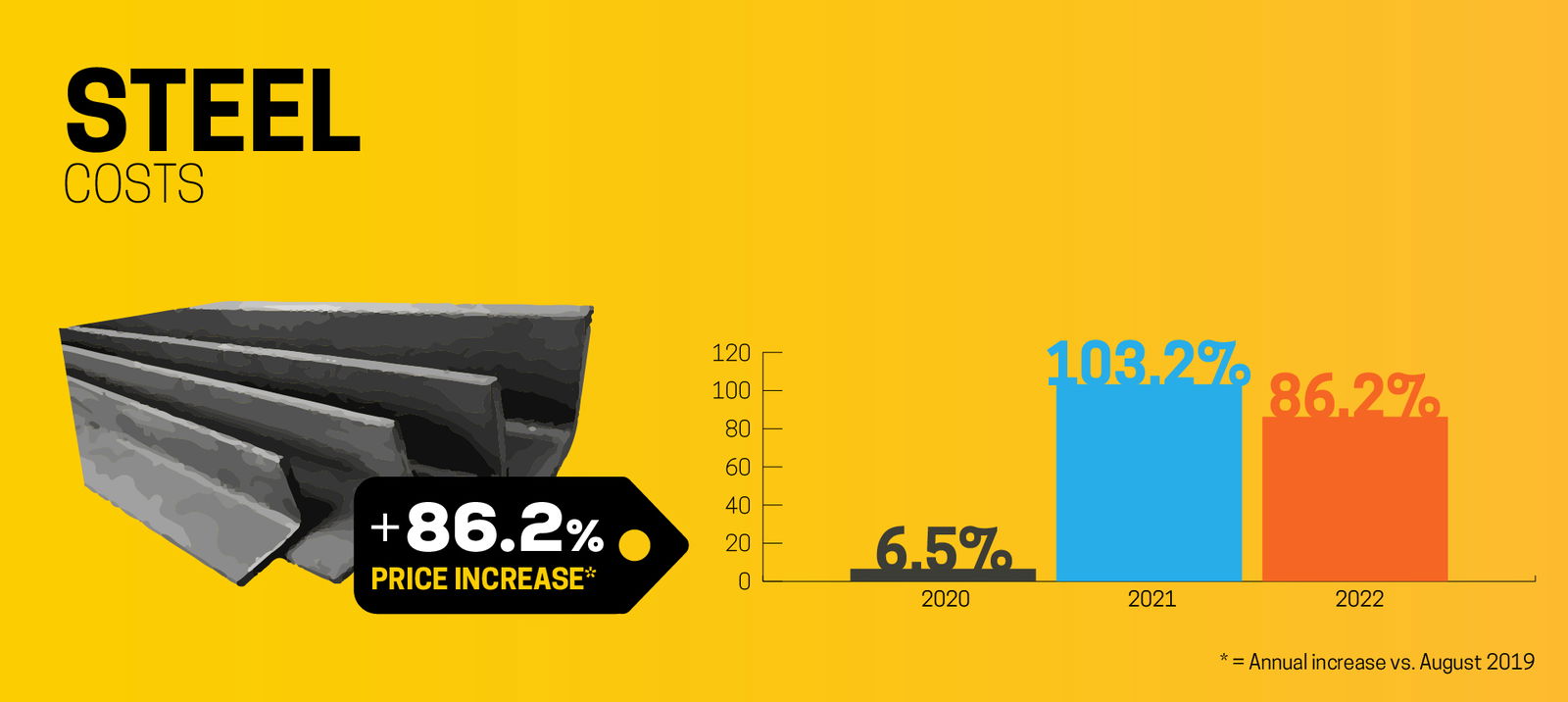

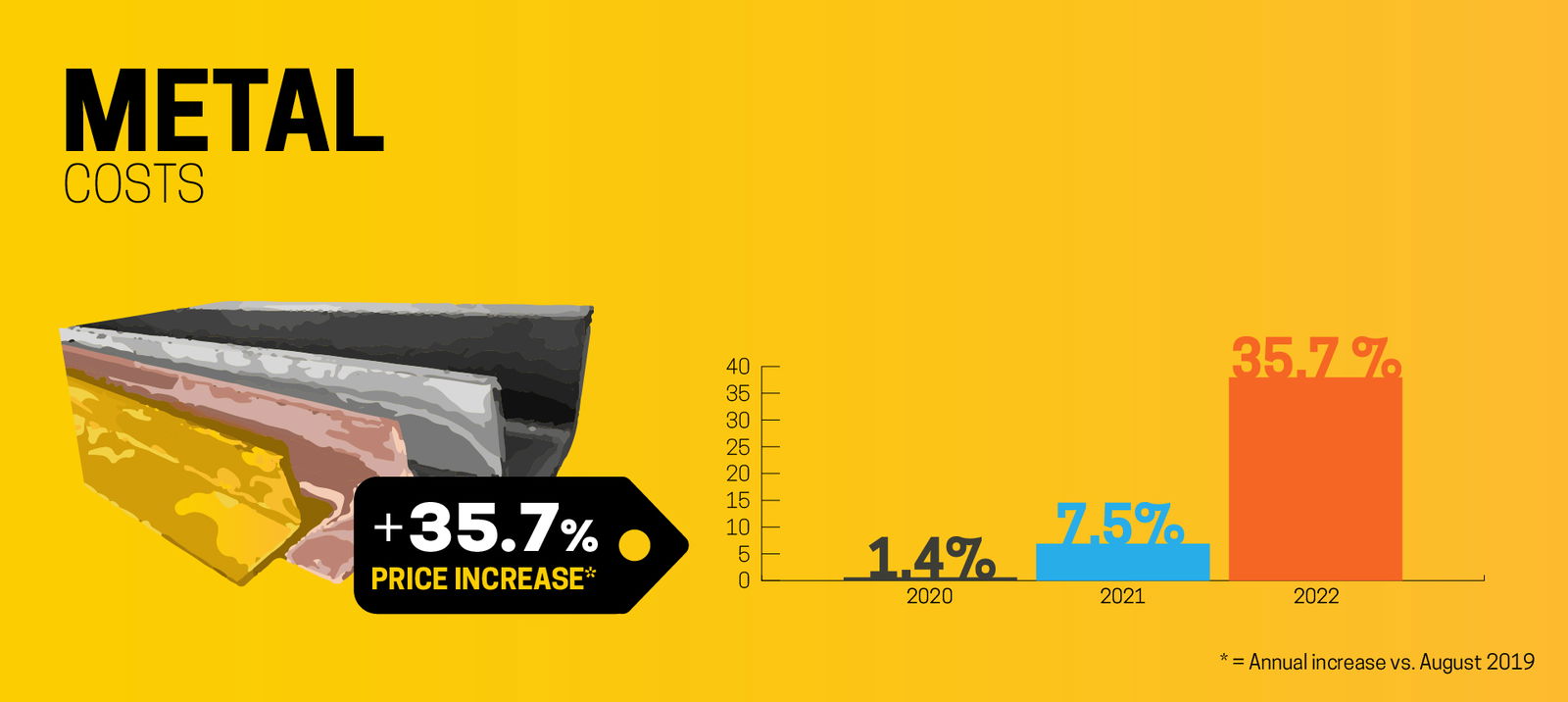

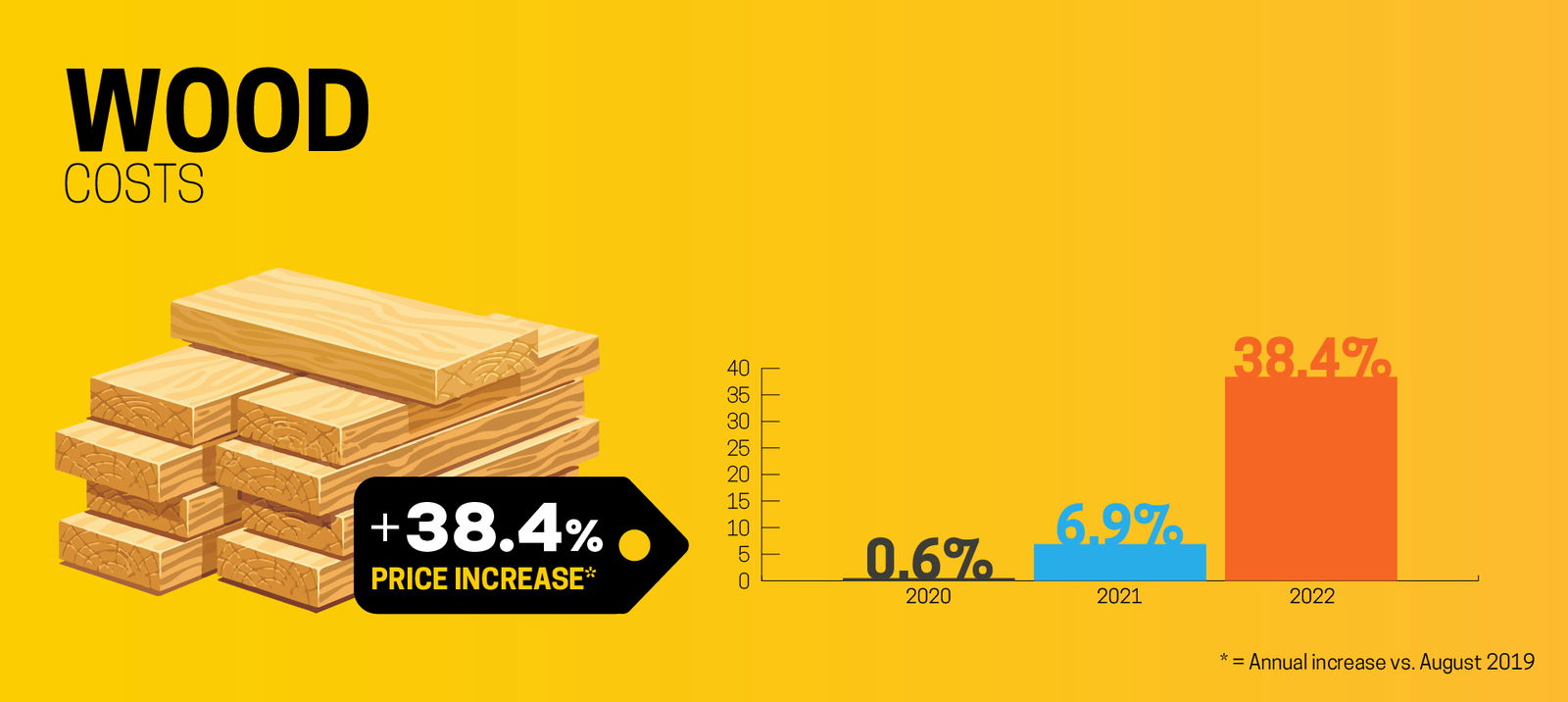

Comparing price levels: a climbing conclusion

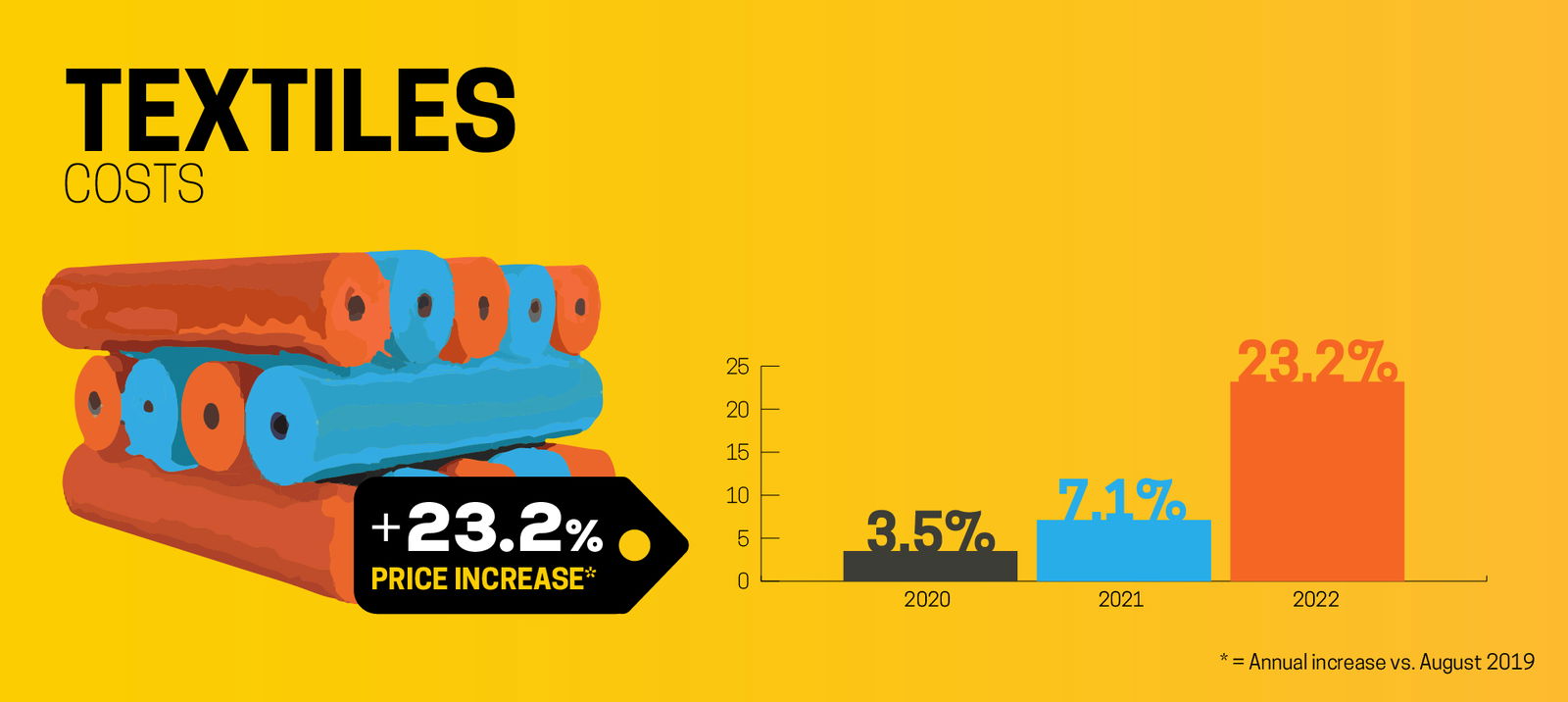

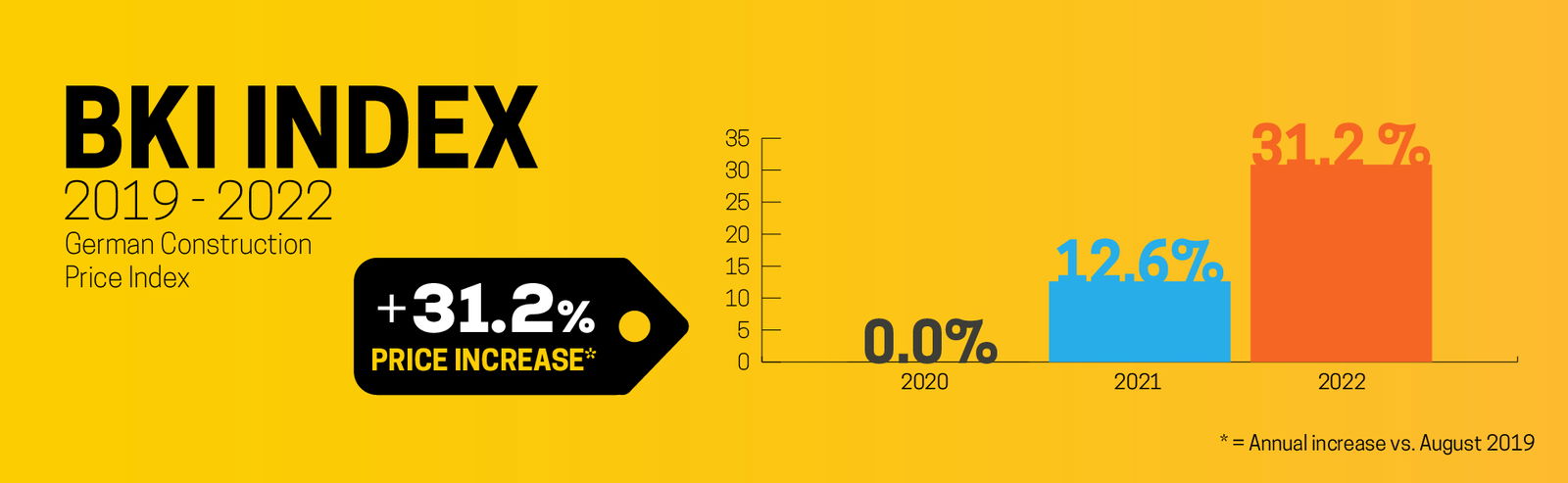

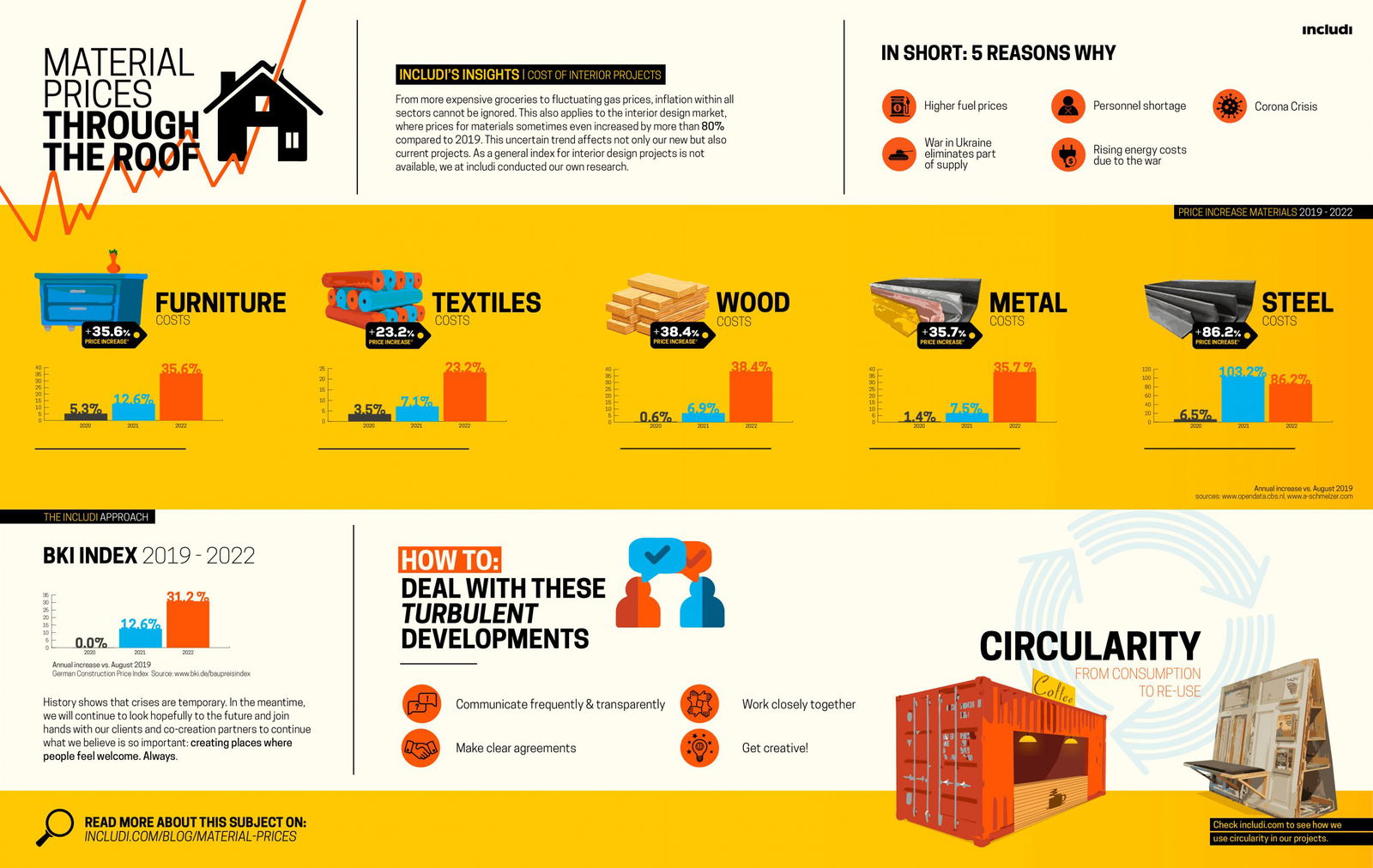

If we compare the price level of 2019 with the price level of 2022, there too we see price hikes. Providers of products and services implement price increases ranging from 10 – 13% in the last year (sources: CBM and Producer). From 2019 – 2022, we see higher price increases, which, depending on the type of product, range from around 23% (textiles) to around 86% (steel). An important raw material for custom interiors is wood, which shows a recent price increase of approx. 38%.

Our own project experience underlines this picture: we observe an approx. 15% price increase over the period 2019 – 2021, and approx. 18% over the subsequent period 2021 – 2022. Cumulatively, this is 38% – just like the approx. 38% price increase of wood, the most important raw material for interior customization. Metal is also an important raw material for interiors, which explains the higher percentage. Unfortunately, recent inflation figures of the general Dutch economy paint an even more unfavorable picture.

How does includi deal with these fluctuating prices?

Considering these figures, the conclusion is clear: prices of raw materials in the interior design market are highly fluctuating and and have mostly risen since 2019. No one knows how long this market will remain unstable. However, we expect the trend outlined in this blog to continue for the foreseeable future. The aftermath of the Corona crisis, the war between Russia and Ukraine, high energy costs reflected in for example steel prices,

uncertainty about transportation and rising fuel costs … these factors all have a major impact on the price of building materials. Crises challenge us. However, a smooth sea never made a skillful sailor. That these challenging times require transparent communication with our clients, clear agreements and close cooperation with all parties involved and (even more) creativity (circularity!) is beyond doubt for includi. Together, we can run a tight ship.

We continuously consult with our clients on how to deal with these uncertain market situations. For example, by anticipating further price increases. Ideally, we prefer to set up the process so we work together in a lean manner, even after a tender, which means we can optimize the project thanks to full transparency. In this way, together with all those involved, we find the right middle ground between the possibilities offered by the market and the wishes of the customer.

Next steps

We continue to look to the future as both optimists and realists; adopting a positive, adaptive and creative attitude. We join forces with our clients and co-creation partners to continue what we consider so important: creating places where people feel welcome, heard and seen. Especially in times of crisis, this is a basic necessity of life.

Sources:

- bki.de

- opendata.cbs.nl

- a-schmelzer.com stahlpreisindex

- cbs.nl inflatie stijgt naar 12 procent in augustus

- abnamro.com visie op rente en euro renteverhoging ecb

- www.rtlnieuws.nl prijzen bouwmaterialen extreem gestegen

- includi tendering results of projects in NL and DE 2019 – 2022

5 Questions For Rem Van Den Bosch